¶ Legal Odyssey

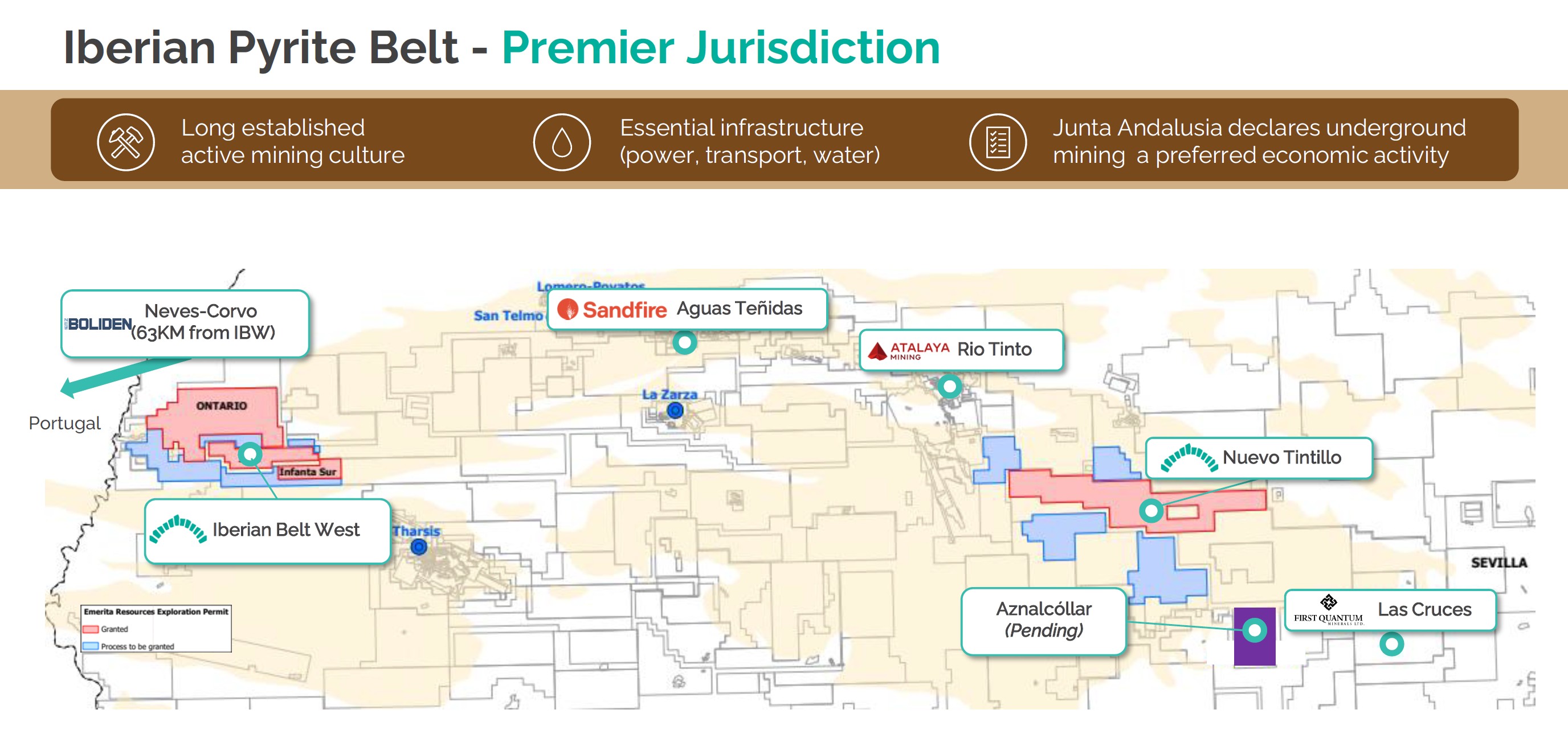

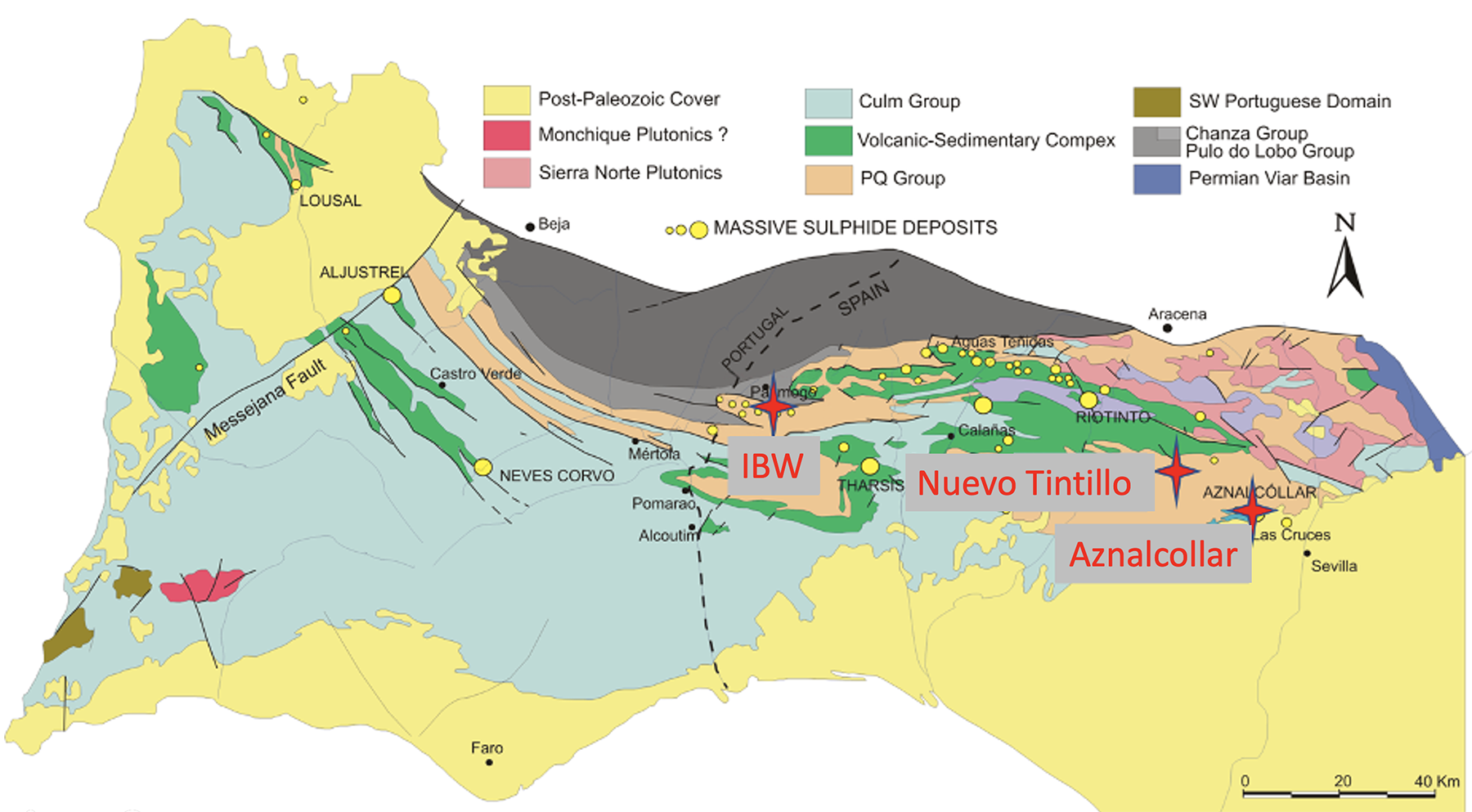

Emerita’s core land packages (IBW, Ontario, and Nuevo Tintillo) were acquired through public tenders and licensing agreements with the Spanish government. The Iberian Belt West (IBW) project (also known as the Paymogo project) was secured after a prolonged legal battle confirming Emerita’s title. Emerita alleged that the public tender process was improperly handled to its detriment. The Ontario permit was awarded in February 2025 without legal drama, expanding their district-scale footprint. Nuevo Tintillo was acquired earlier and represents Emerita’s early-stage exploration frontier. The company is now the dominant landholder in the western Iberian Pyrite Belt.

Map of southern Spain’s Iberian Pyrite Belt showing the locations of the Paymogo/IBW project (red outline, near the Portugal border) and the Aznalcóllar mine (far right). Both projects became subject to contentious tender processes.

¶ Iberian Belt West (Paymogo) Tender Dispute (2014–2020)

Emerita’s other major legal battle in Spain involved the Iberian Belt West (IBW) project – also known as the Paymogo zinc project – located in Huelva province near the Portuguese border. This area hosts the La Romanera and La Infanta base-metal deposits within the prolific Iberian Pyrite Belt (globenewswire.com)(juniorminingnetwork.com). In early 2014, the Junta de Andalucía offered the Paymogo exploration permit via a competitive public tender. Emerita and Minera Aguas Teñidas S.A. (MATSA) – a mining company owned by Trafigura and Mubadala – were among the bidders. The tender process concluded in April 2014 with the Junta awarding the IBW project to MATSA, the then-current permit holder (juniorminingnetwork.com). Emerita’s bid, despite being technically robust, was not selected. Believing the evaluation had been unfair, Emerita promptly filed an administrative appeal in 2014 contesting the decision (juniorminingnetwork.com).

¶ Court Appeal and Reversal

After a protracted legal review, Emerita achieved a decisive victory. In September 2017, the High Court of Justice of Andalusia (Tribunal Superior de Justicia de Andalucía, TSJA) ruled in favor of Emerita’s appeal and annulled the original award of the Paymogo/IBW tender to MATSA (juniorminingnetwork.com) (juniorminingnetwork.com). The court found that the government’s selection process had violated the principles of equality and transparency. Notably, it was determined that the tender committee had applied evaluation criteria that were never disclosed in the official tender terms, which unjustly advantaged MATSA’s proposal (juniorminingnetwork.com)(globenewswire.com). The TSJA ordered the tender bids to be reassessed without the illegal criteria that had been used. In practical terms, this meant rescoring the Emerita and MATSA bids solely on the legitimate published factors. The Junta de Andalucía (then under a different regional administration) initially appealed the High Court’s ruling to Spain’s Supreme Court, seeking to uphold the award to MATSA (globenewswire.com). However, in November 2019 the Supreme Court of Spain dismissed the Junta’s appeal, definitively confirming that Emerita’s rights had been violated in the original tender and that the process must be corrected (globenewswire.com)(globenewswire.com). The courts provided a clear outcome: once the improper scoring factors were removed, Emerita’s bid outscored MATSA’s (Emerita earned ~34.46 points vs. 29.37 for MATSA) – making Emerita the legitimate winner of the public tender (globenewswire.com).

¶ Basis of Emerita’s Claim

Emerita’s successful challenge of the IBW tender was grounded in several specific complaints about how the bidding was handled, which the courts ultimately found credible. In summary, Emerita argued and demonstrated that:

¶ Undisclosed Scoring Criteria

The tender panel had awarded points to MATSA on evaluation criteria that were never stated in the public tender documentation (globenewswire.com). Because other companies were unaware of these extra categories, they could not address them in their bids, resulting in an unfair scoring advantage for MATSA (globenewswire.com). (For example, the panel had introduced two additional scoring categories – identified as “C” and “H” – outside the official criteria, which boosted MATSA’s score (globenewswire.com).)

¶ Ineligible Bidder Issue

MATSA had previously held the mineral rights for the Paymogo project (prior to the tender) but had lost those rights when the permits were revoked by the Junta due to MATSA’s failure to fulfill its exploration work obligations (juniorminingnetwork.com). Emerita cited Spanish legal precedents indicating that a company which failed to meet its obligations on a concession could be barred from re-bidding on the same property (juniorminingnetwork.com). Despite this, MATSA was allowed to participate and ultimately win the 2014 tender. Emerita contended this was improper given MATSA’s prior default on the project.

¶ Procedural/Technical Errors

MATSA’s bid contained technical errors and omissions that ordinarily “should have been sufficient to invalidate its bid” under the law (juniorminingnetwork.com). These errors were apparently overlooked by the evaluation committee. Emerita held that a strict and impartial application of the tender rules would have disqualified MATSA’s proposal, leaving Emerita as the top qualified bidder.

The High Court’s 2017 judgment echoed these points, concluding that the tender committee “made an arbitrary assessment of the bids favoring one bidder to the detriment of the others,” and that key principles of objectivity and fairness were breached in the IBW competition (juniorminingnetwork.com). Following the Supreme Court’s affirmation in 2019, the Andalusian authorities moved to comply with the rulings. Emerita was officially notified on September 1, 2020, that it had been declared the winning bidder for the IBW/Paymogo mineral rights by order of the provincial Ministry of Industry in Huelva (emeritaresources.com). The resolution recognized Emerita’s Spanish subsidiary as the holder of the IBW exploration permit, finally resolving the six-year dispute in Emerita’s favor (emeritaresources.com).

With title to the project secured, Emerita promptly proceeded with exploration at IBW. By late 2020, the company had commenced drilling on the property’s known deposits (La Romanera, La Infanta, and El Cura) to verify and expand their resources (emeritaresources.com). Emerita’s management welcomed the court outcome, noting that they were prepared to “meet immediately with the Mining Authorities … and initiate the work program for the project” as soon as the tender was finalized (globenewswire.com). In the years since, IBW has become a flagship project for Emerita, while the Aznalcóllar case, though similar in highlighting a flawed tender process, remains tied up in legal proceedings.

¶ Comparison and Aftermath

Both the Aznalcóllar and IBW cases underscore the challenges Emerita faced with Andalusia’s public tender system. In each instance, Emerita pursued legal action to expose irregularities after being passed over for a project it believed it had won on merit. The IBW (Paymogo) battle was resolved through the administrative courts, resulting in Emerita securing the project by 2020 (emeritaresources.com). In contrast, the Aznalcóllar saga expanded into a criminal corruption probe involving government officials; as a result, that mine’s development has been frozen pending the outcome of trials and appeals (emeritaresources.com)(emeritaresources.com). Emerita’s consistent position has been that it rightfully won both tenders and that transparent, rule-based adjudication would favor its proposals. The company’s persistence in legal channels ultimately paid off in the IBW case, and it remains to be seen if the courts will deliver a similar vindication regarding Aznalcóllar. In the meantime, Emerita continues to advance the IBW project and has signaled its readiness to assume the Aznalcóllar mining rights should the opportunity arise (globenewswire.com)(globenewswire.com).

¶ Sources

Emerita Resources – Management’s Discussion & Analysis (2024) (emeritaresources.com) (emeritaresources.com) (emeritaresources.com) (emeritaresources.com)

Emerita Resources Corp. press releases (2015) on the Aznalcóllar tender appeal and court findings (globenewswire.com) (globenewswire.com) (globenewswire.com) (globenewswire.com)

Court ruling summaries on the Paymogo/IBW tender (High Court of Andalusia 2017; Supreme Court 2019) as reported by Emerita Resources (juniorminingnetwork.com) (juniorminingnetwork.com) (globenewswire.com)

¶ Land Packages & Deposits

Emerita’s core land packages (IBW, Ontario, and Nuevo Tintillo) were acquired through public tenders and licensing agreements with the Spanish government. IBW was secured after a prolonged legal battle confirming Emerita’s title. The Ontario permit was awarded in February 2025, expanding their district-scale footprint. Nuevo Tintillo was acquired earlier and represents Emerita’s early-stage exploration frontier. The company is now the dominant landholder in the western Iberian Pyrite Belt.

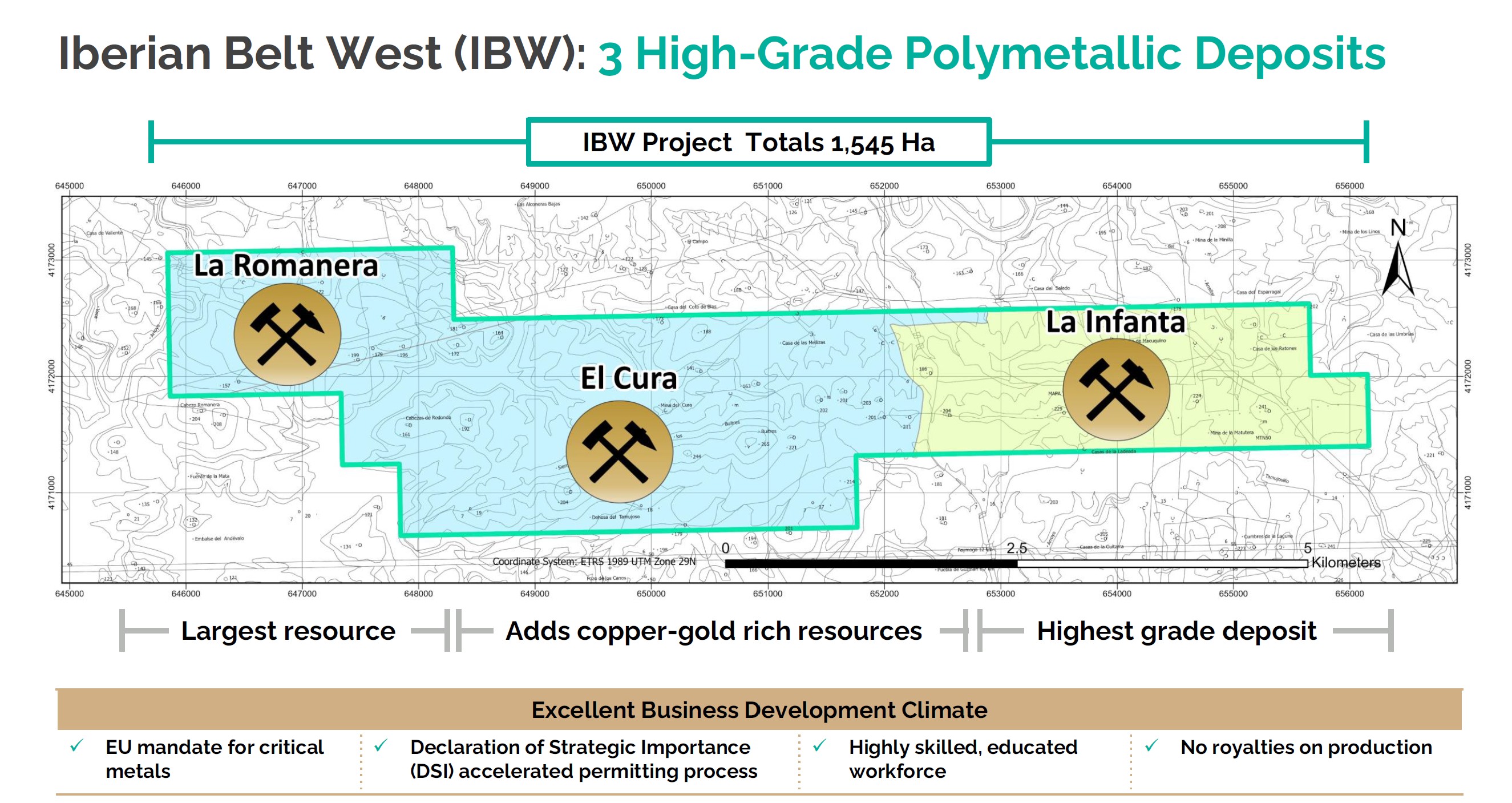

All three deposits in IBW are part of the Iberian Pyrite Belt, one of the world’s most prolific VMS (Volcanogenic Massive Sulphide) terrains. These deposits are stratabound, multi-element systems containing zinc, lead, copper, silver, and gold. La Romanera and La Infanta lie within the volcanic-sedimentary contact zone typical of large VMS clusters. El Cura may represent the feeder zone for this system. Ontario appears to lie along a western continuation of the same stratigraphy, suggesting geological continuity across the land package.

¶

La Romanera

La Romanera is the flagship deposit within the IBW project, hosting the bulk of the current resource. As of March 2025, it contains an estimated 18.77 Mt of indicated and inferred resources. The mineralisation consists of zinc, copper, lead, silver, and gold — typical of a VMS system. The deposit begins at or near surface and remains open at depth. Emerita’s metallurgical tests show recoveries of 90.4% Zn, 52.2% Pb, 84% Cu, 80.1% Ag and 64.1% Au, with further optimisation targeting >80% Au recovery. Romanera will likely anchor the central processing infrastructure and is the dominant contributor to the IBW project's mine plan.

¶ El Cura

El Cura lies between Romanera and La Infanta and has emerged as a potential Cu-Au feeder conduit in the system. While it currently hosts only 0.94 Mt of inferred resource, its geological significance is growing. Historic mining and recent drilling show copper-gold rich mineralisation consistent with a feeder zone, and the company believes it may structurally connect to the newly permitted Ontario concession. Metallurgical recovery assumptions include 92% Cu and 64.1% Au, positioning El Cura as the primary contributor to IBW's gold leverage.

¶ La Infanta

La Infanta is a high-grade, near-surface deposit known for its exceptional polymetallic grades, historically up to 20% Zn, 10–15% Pb, and 150–300 g/t Ag. It contains 6.05 Mt of combined indicated and inferred resource. It was originally drilled by majors in the 1980s, but past owners were constrained by property boundaries. Emerita's control of contiguous ground has allowed a step-out program that significantly expanded the known zone. Metallurgical testing yielded 93% Cu, 95.6% Ag, and 79.9% Au recovery.

¶ Exploration Properties

¶

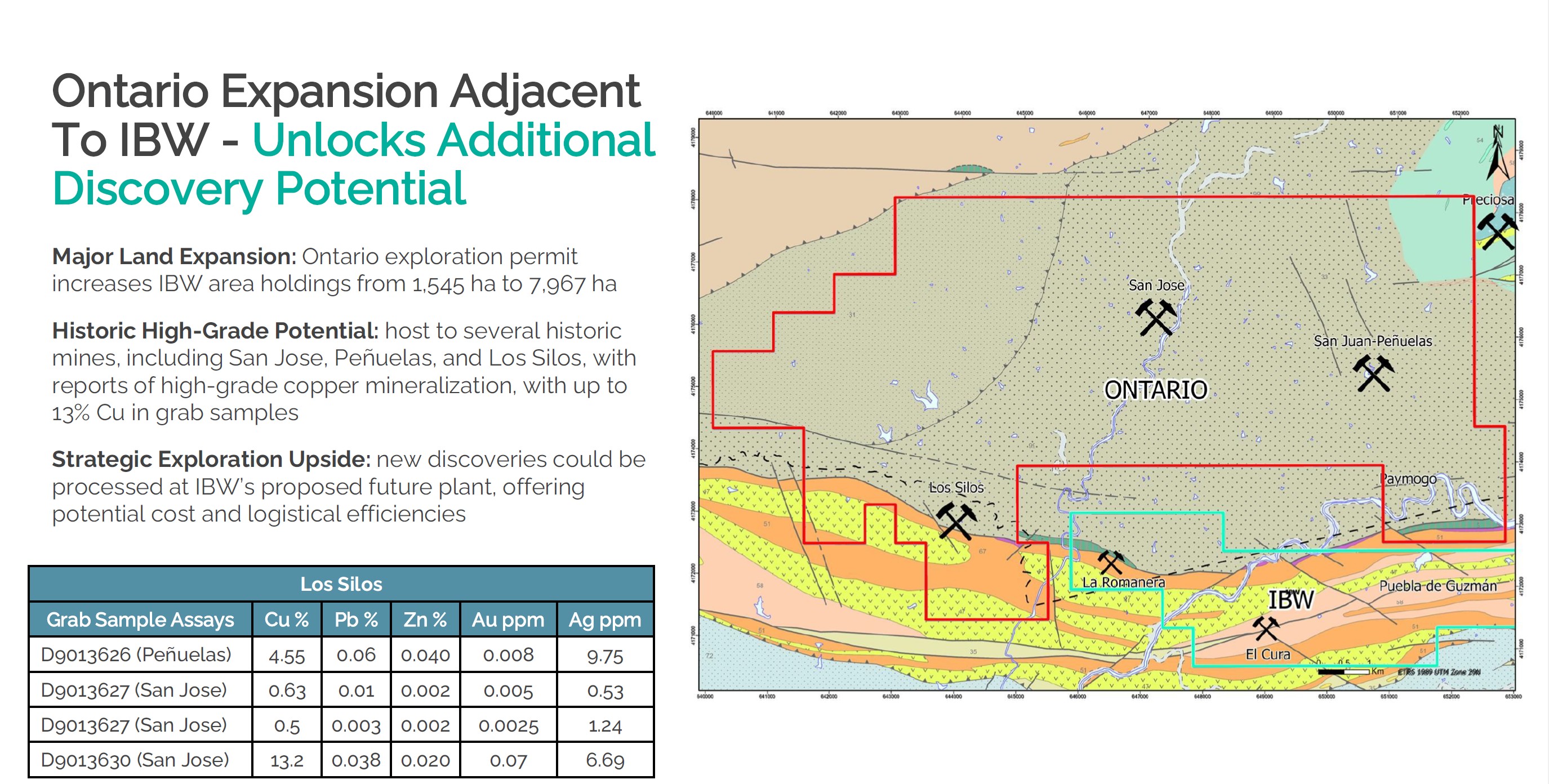

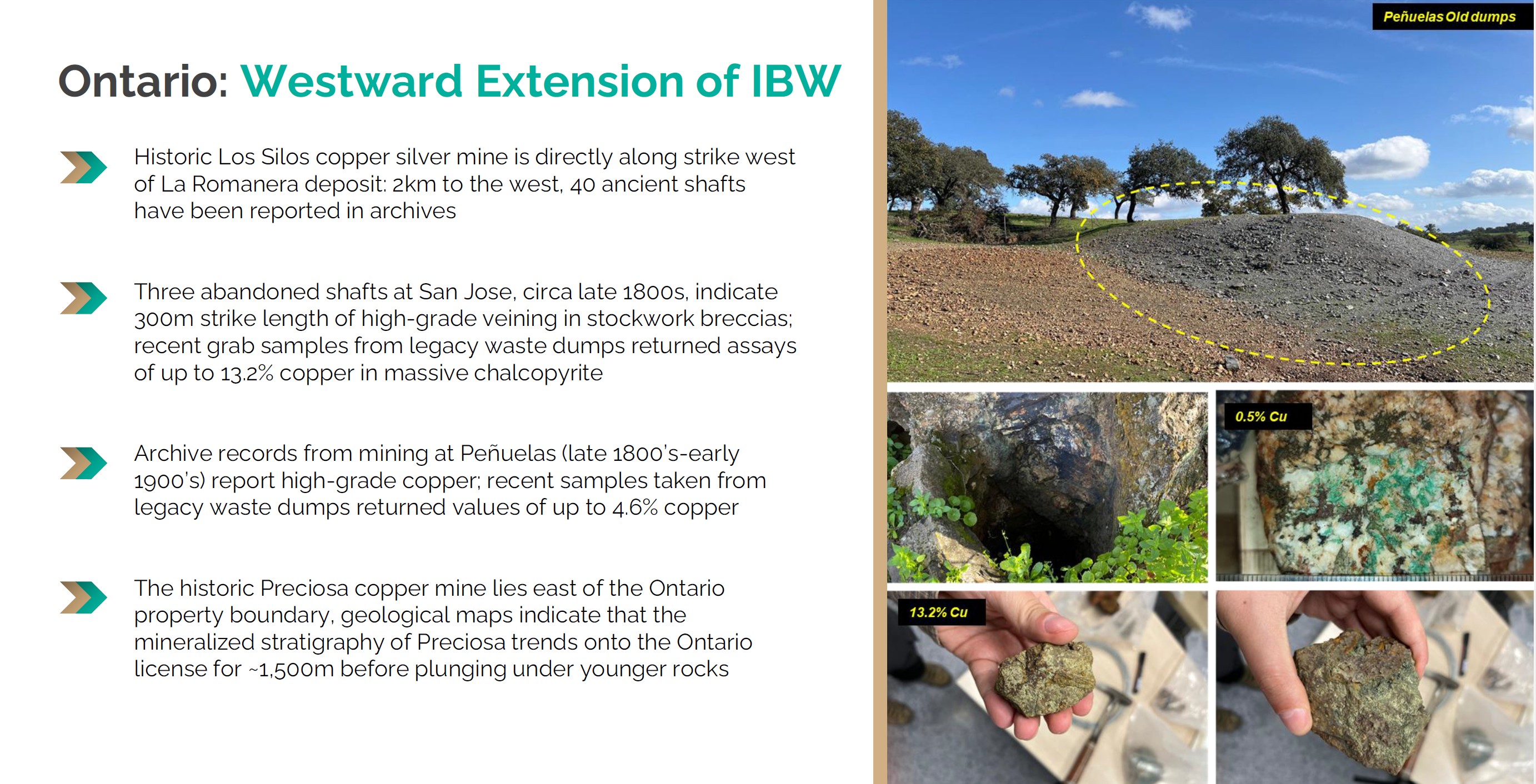

Ontario

The Ontario property was officially permitted in February 2025, adding 5,600 hectares directly adjacent to the IBW project. This strategic acquisition more than doubles Emerita’s land package to nearly 8,000 hectares in the western Iberian Pyrite Belt. Ontario is not a greenfield project: it contains multiple historic high-grade copper-gold workings, with surface grab samples historically returning up to 13.2% Cu. The company believes the same mineralised structures identified at El Cura and Romanera extend into Ontario. Initial exploration work is underway.

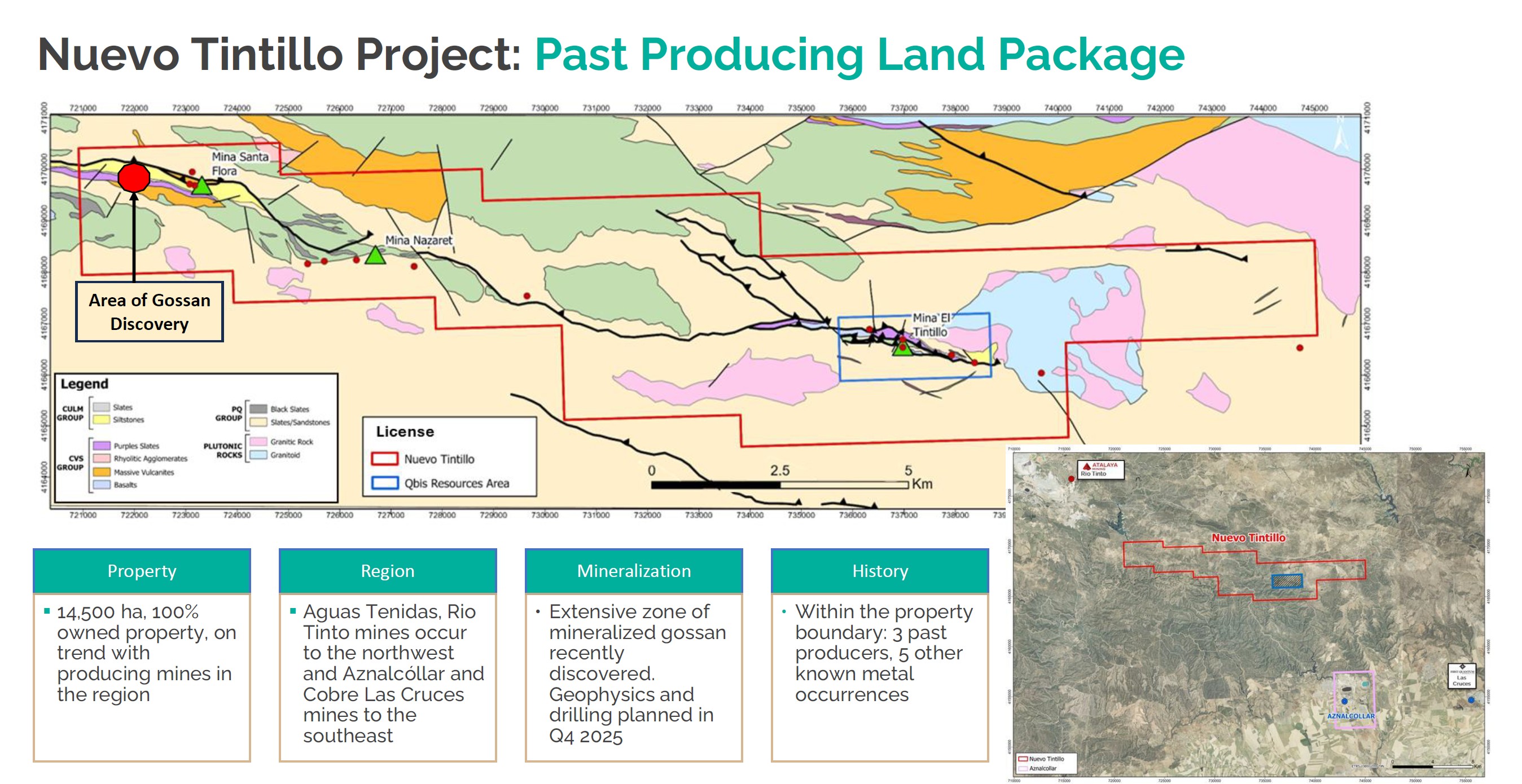

¶ Nuevo Tintillo

Nuevo Tintillo is a large-scale property south-east of IBW, covering 14,500 hectares and 100% owned by Emerita. It includes three past-producing mines and five known mineral occurrences. In 2024, 4,300 metres of scout drilling were completed and two surface gossan zones were identified. Geophysics outlined 15 conductors, and assays have confirmed mineralised systems (e.g., 3.37 g/t Au and 165 g/t Ag in surface samples). Tintillo lies along the same trend as producing mines such as Aguas Teñidas and Las Cruces, indicating high discovery potential.

¶ Geology of the Iberian Belt West (IBW) Project

¶ Geological Context - The Iberian Pyrite Belt (IPB)

The Iberian Pyrite Belt (IPB) is one of the most prolific Volcanogenic Massive Sulphide (VMS) provinces in the world, stretching across southeastern Portugal and southwestern Spain for over 250 km. This ancient geological formation dates back to the Upper Paleozoic era (Devonian–Carboniferous) and is host to more than 90 VMS deposits, including some of the largest known globally, such as Rio Tinto, Neves Corvo, and Aljustrel.

The IPB is composed of a thick sequence of submarine volcanic and sedimentary rocks formed in a tectonically active, back-arc basin setting. Its remarkable mineral endowment includes:

Massive sulphide ore bodies rich in zinc (Zn), lead (Pb), copper (Cu)

High concentrations of silver (Ag) and gold (Au) as by-products

Complex polymetallic zonation due to hydrothermal alteration and tectonic deformation

The belt has been mined for over 3,000 years, and in modern times has become the focus of renewed exploration interest, particularly due to its strategic metals critical for green technologies.

¶ What Are Volcanogenic Massive Sulphide (VMS) Deposits?

Volcanogenic Massive Sulphide (VMS) deposits are formed on or near the seafloor by hydrothermal vents in submarine volcanic environments. These deposits occur when:

Seawater infiltrates the oceanic crust through faults and fractures;

It gets heated by underlying magma and becomes enriched in metals;

The metal-rich fluid ascends and discharges at the seafloor;

Upon contact with cold seawater, the dissolved metals precipitate as sulphide minerals, forming massive layers of sulphide-rich ore.

The deposits typically contain:

- Sphalerite (ZnS)

- Galena (PbS)

- Chalcopyrite (CuFeS₂)

- Pyrite (FeS₂)

- Plus significant Ag and Au enrichment in some cases

VMS systems often exhibit metal zoning — copper-rich near the vent and zinc-lead rich laterally — and are usually associated with strong alteration halos in the surrounding rocks (chlorite, sericite, silica).

¶ Geology of the IBW Project

Emerita’s Iberian Belt West (IBW) Project is located in the western extension of the IPB in Huelva Province, Andalusia, Spain. The project encompasses multiple mineralized zones including La Infanta, Romanera, and El Cura, all situated along a continuous trend of known VMS occurrences.

¶ Key Geological Characteristics:

The stratigraphy at IBW is dominated by the Volcanic-Sedimentary Complex (VSC) of the IPB, underlain by older phyllitic and schistose rocks of the PQ (Phyllite–Quartzite) Group.

The VSC is composed of felsic to intermediate volcanic rocks, shale, and chert with intercalated horizons of massive sulphide bodies.

Mineralization occurs as lens-shaped, stratabound massive sulphide deposits typically hosted at or near the contact between rhyolitic volcanic rocks and black shales.

Faulting and folding have affected deposit geometry, but mineral continuity has been preserved across several hundred metres in strike and depth.

¶ Deposit Highlights:

¶ 🔹 La Infanta

High-grade Zn-Pb-Cu-Ag VMS lens with exceptional historic grades.

Emerita’s drilling has confirmed near-surface extensions and mineral continuity at depth.

Hosted in silicified and sericitized volcaniclastics with strong sphalerite, galena, and chalcopyrite development.

¶ 🔹 Romanera

One of the largest known undeveloped VMS bodies in the western IPB.

Historical work defined a significant resource, which Emerita is updating with modern drilling and resource modeling.

Displays a classic VMS zonation: Cu-rich core transitioning to Zn-Pb-Ag enriched flanks.

¶ 🔹 El Cura

Smaller, high-grade zone with potential for satellite development.

Structurally complex but strategically located between Romanera and La Infanta, suggesting strong mineral potential.

¶ Alteration and Mineral Zonation

Typical alteration assemblages include:

Silicification near the vent areas

Sericite–chlorite halos surrounding mineralized zones

Minor carbonatization and quartz–pyrite veinlets peripheral to the ore bodies

Metal zoning is observed with:

Central chalcopyrite-rich zones (copper)

Intermediate sphalerite–galena (zinc-lead)

Peripheral silver enrichment and gold traces

¶ Exploration Implications

The geology of the IBW project is consistent with classic VMS systems, and its location within the western IPB — relatively underexplored compared to its eastern counterpart — gives Emerita strong upside potential for further discoveries.

The stacked lens geometry, favorable host rocks, and strong historical drill results support the likelihood of both lateral and vertical extensions. Emerita continues to integrate modern geophysics, relogging, and structural modeling to optimize its drill targeting and expand known resources.

¶

Mineral Resource

The Iberian Belt West (IBW) Project is hosted within the renowned Iberian Pyrite Belt, one of the most productive volcanogenic massive sulfide (VMS) terrains in the world. The IBW Project encompasses three polymetallic deposits. From east to west: Infanta, El Cura, and Romanera. The area has a long history of mining activity that dates back as far as Roman times. Previous exploration of the deposits was conducted by major companies including Asturiana, RTZ and Phelps Dodge in the 1970’s and 1980’s. The IBW Project is located in the western part of the belt, adjacent to the border with Portugal, approximately 144km west of Seville and 50km from the port city of Huelva. The Project extends along a strike length of approximately 12km. Access to the IBW Project is excellent via paved and all-weather gravel roads.

The Romanera deposit was drilled primarily by Minera Rio Tinto in the 1990’s and is reported to contain 34 million tonnes grading 0.42% copper, 2.20% lead, 2.3% zinc, 44.4 g/t silver and 0.8 g/t gold, within which there is a higher-grade resource of 11.21 million tonnes grading 0.40% copper, 2.47% lead, 5.50% zinc, 64.0 g/t silver and 1.0 g/t gold (The Volcanic Hosted Massive Sulphide Deposits of the Iberian Pyrite Belt, Garcia-Cortes ed., 2011). A qualified person, as defined by NI 43-101, has not done sufficient work on behalf of Emerita to classify the historical estimate reported above as current mineral resources or mineral reserves, and Emerita is not treating the historical estimate as such. The historical estimate should not be relied upon. The deposit extends from surface to approximately 550 metres depth on historical drilling. The mineralization remains open for further expansion down dip beyond the limits of the existing drilling.

The La Infanta mineralized zone has been drilled from surface where it outcrops to a depth of approximately 400 metres. Numerous high-grade intercepts occur within the zone, and it remains open for expansion at shallow depths. La Infanta is located approximately 8km to the east of the La Romanera deposit.

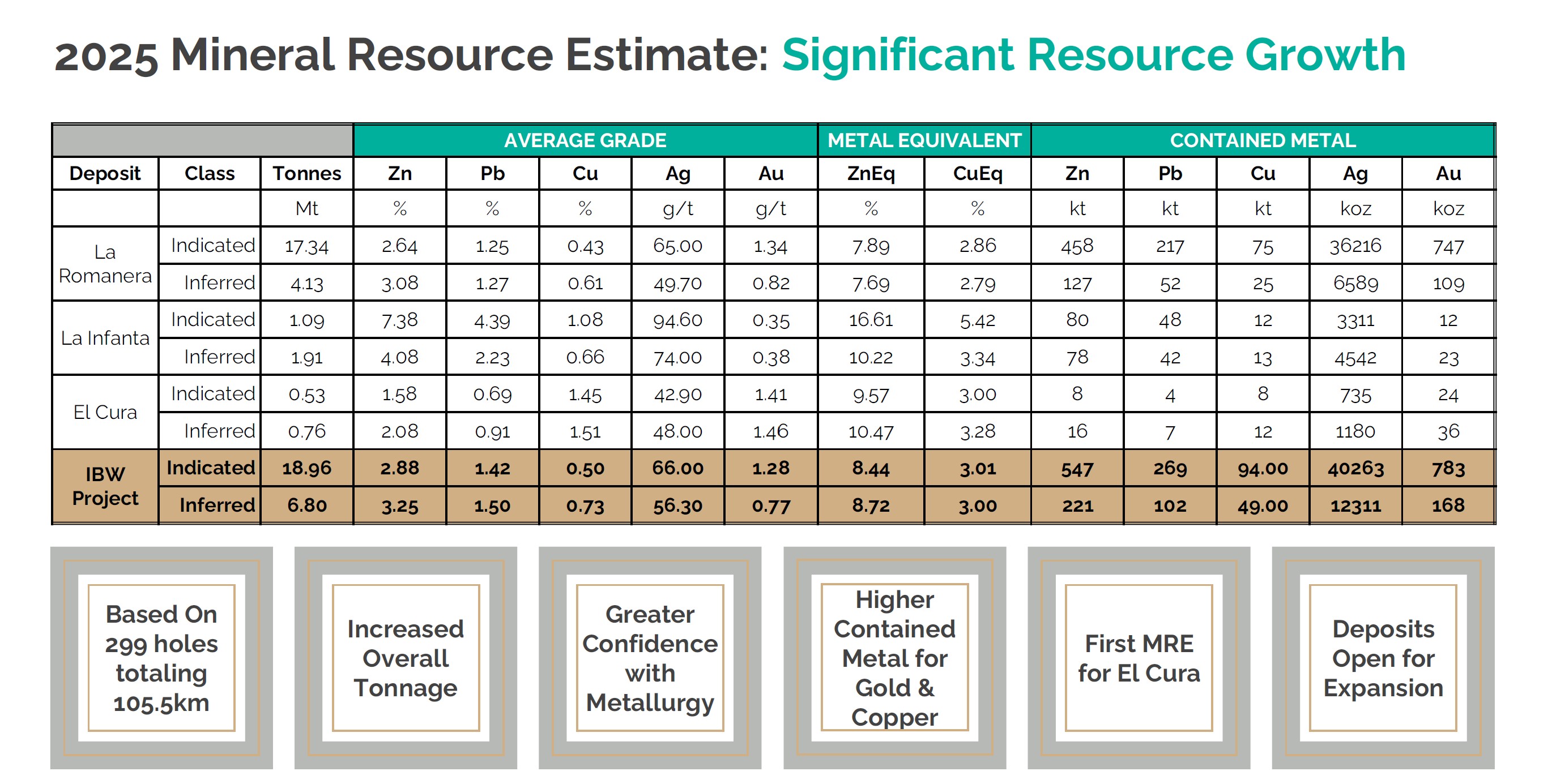

Emerita released an updated NI 43-101 compliant mineral resource estimate for La Romanera, El Cura, and La Infanta deposits that contains a combined 25.76 Mt resource that includes a 18.96 Mt indicated resource at 8.44% ZnEq (3.01% CuEq) and a 6.80 Mt inferred resource at 8.72% ZnEq (3.00% CuEq).

¶ Metallurgy

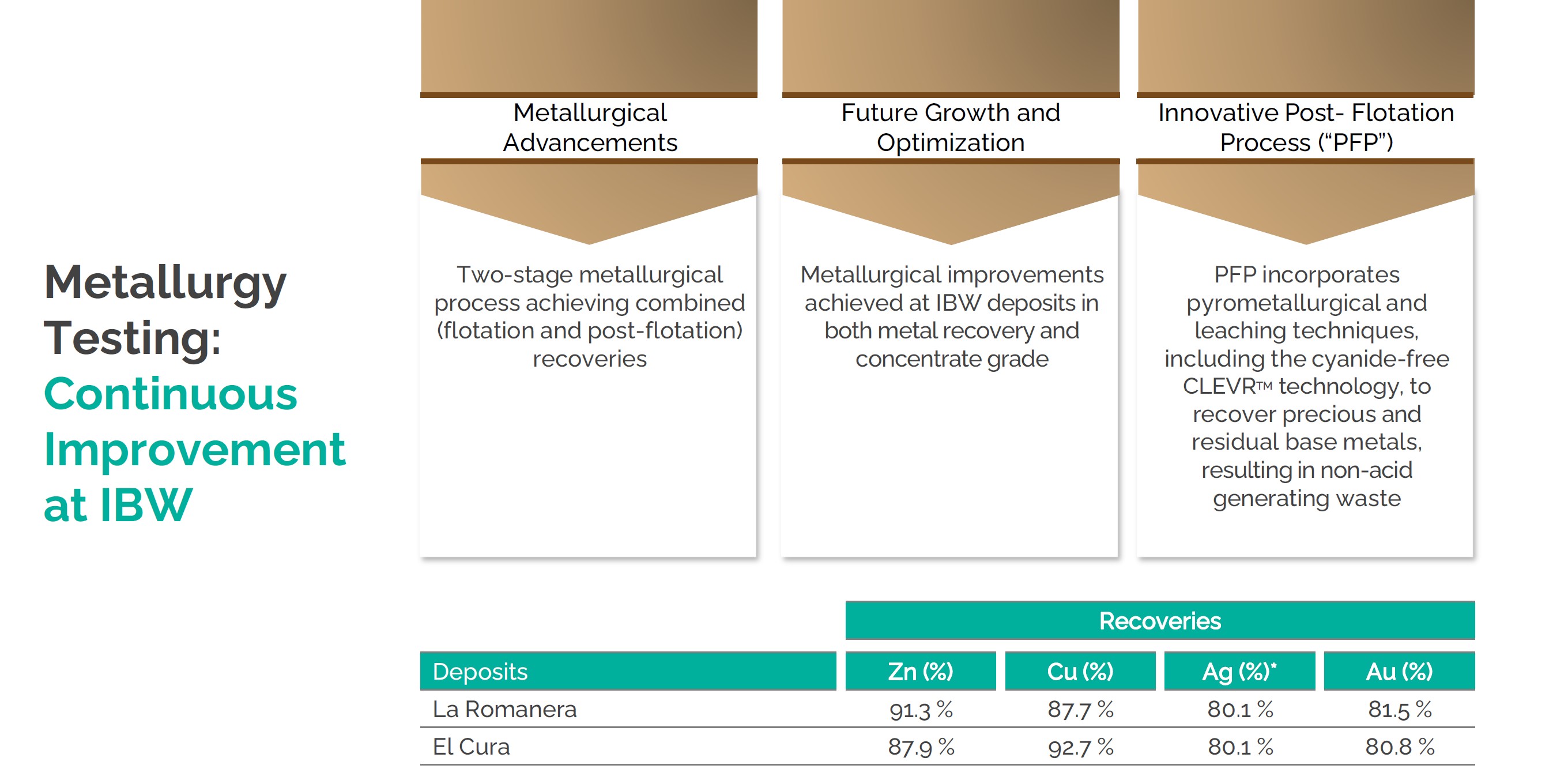

Emerita has undertaken an extensive multi-year metallurgical testing program to support feasibility work for the Iberian Belt West (IBW) Project, targeting optimization of both base and precious metals recovery from the La Romanera, El Cura and La Infanta deposits. The program has involved collaboration with Wardell Armstrong International for flotation test work and Dundee Sustainable Technologies (DST) for post-flotation gold recovery using their CLEVR Process™.

- Results for Metallurgical Testing Phase 1

- Results for Metallurgical Testing Phase 2

- Results for Metallurgical Testing Phase 3

- 35% Improvement in MRE

- Updated 43-101 with 35% Improvement in MRE

- Results for Metallurgical Testing Phase 4

“The Company’s continuing investigation into the post-flotation process optimization has shown a dramatic improvement in gold recovery for the IBW Project. If we were to calculate the impact these results on recovered metals, compared to the initial results (MRE) it would translate into an additional recovery of 159,000 ounces of gold. This would represent an important margin improvement to the IBW Project.” - Joaquin Merino, P.Geo., President of Emerita

¶ Two-Stage Processing Design

The processing flowsheet is based on a Two-Stage Metallurgical Process:

- Stage 1: Conventional flotation for base metals (Zn, Cu).

- Stage 2: CLEVR™ post-flotation process for enhanced gold recovery using non-cyanide leaching.

This hybrid process enables Emerita to maximize overall recoveries and reduce environmental liabilities, supporting its goal of building a low-impact mine aligned with EU sustainability standards.

¶ Updated Recovery Metrics (as of May 27, 2025)

| Deposit | Zn Recovery | Cu Recovery | Au Recovery |

|---|---|---|---|

| La Romanera | 91.3% | 87.7% | 81.5% |

| El Cura | 87.9% | 92.7% | 80.8% |

This latest update represents a 17% improvement in gold recovery over the 64.1% baseline used in the 2025 MRE. The CLEVR Process also reduces arsenic by 90% and sulfides by 97.8%, cutting waste generation by roughly 50% and eliminating acid-generating tailings.

¶ Implications for Project Economics

According to Emerita’s internal calculations, this uplift in gold recovery would translate to ~159,000 oz of additional recovered gold, based on current grades in the 2025 NI 43-101 MRE. These gains push the gold-equivalent grade (AuEq) to ~4.53 g/t, with equivalent grades of 8.80% ZnEq or 3.14% CuEq, using consistent metal pricing.

¶ Environmental and Technical Advantage

The CLEVR Process™ is cyanide-free, aligning with European Union environmental regulations and positioning IBW as a green-mine leader in the Iberian Pyrite Belt. High-quality, saleable concentrates with minimal deleterious elements ensure strong commercial viability.

“This dramatic improvement in gold recovery would translate into a significant margin increase for the IBW Project. Our goal is to maintain the highest environmental standards while maximizing economic return.”

— Joaquin Merino, P.Geo., President of Emerita Resources

¶ Declaration of Strategic Interest

The Iberian Belt West (IBW) Project was officially designated a Project of Strategic Interest (Proyecto de Interés Estratégico) by the Junta de Andalucía in 2024. This designation is a formal recognition by the regional government that IBW plays a key role in the economic, technological, and strategic development of Andalusia — particularly in the context of critical raw materials security and industrial decarbonization. This designation streamlines permitting and grants IBW priority status within regional development goals. It also aligns with the European Union’s Critical Raw Materials strategy, reinforcing Emerita’s eligibility for infrastructure and development incentives. Emerita is participating in the Raw Materials Valley initiative, which aims to make Huelva a regional mining hub.

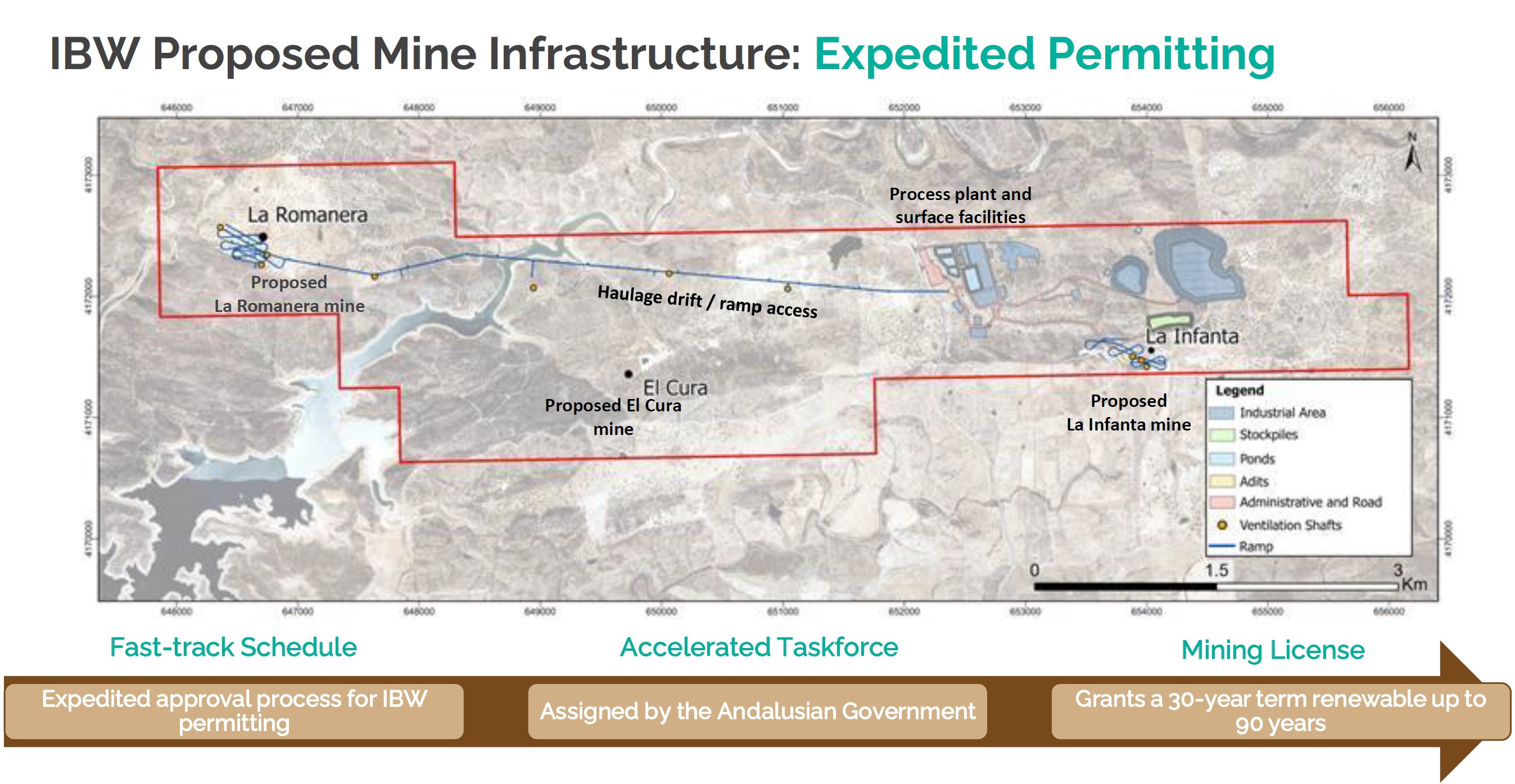

¶ Fast-Track Permitting and Priority Administrative Processing

The strategic designation triggers a preferential administrative channel under Andalusian law, which coordinates all necessary permits across departments, reduces waiting periods for approvals (e.g., environmental, land-use, and exploitation permits), provides clear timelines and oversight under the Junta’s Office for Strategic Projects. This ensures IBW is treated as a regional priority, not a standard mining concession.

¶ Access to Strategic Funding and Industrial Programs

As a Strategic Interest Project aligned with the EU’s Critical Raw Materials Act, IBW is now integrated into the Raw Materials Valley Huelva Initiative — a regional development program aimed at creating a critical raw materials hub in southern Spain. Eligibility for European and national funding aimed at supporting supply chain resilience and regional economic transition. Emerita has actively engaged in discussions around the Raw Materials Valley initiative and has signaled intent to integrate IBW into local employment, processing, and training networks.

“We believe the recognition of IBW as a Strategic Interest Project will allow us to move swiftly through permitting and become a cornerstone of the new mining economy in the region.”

— Joaquín Merino, President, Emerita Resources

Additionally, this designation enhances Emerita’s credibility and positioning as a near-term producer, not just an exploration company. It also increases Emerita’s visibility and relevance at the national level, potentially offering leverage in the broader narrative shift away from the Aznalcóllar corruption legacy toward economic development, job creation, and strategic autonomy in metals.

The declaration of Strategic Interest not only de-risks IBW from a permitting standpoint, but also embeds Emerita into broader EU and regional policy frameworks — creating a smoother, faster path to construction and enhancing the potential for downstream partnerships and funding support.

Company News Release - July 2024

¶

Permitting

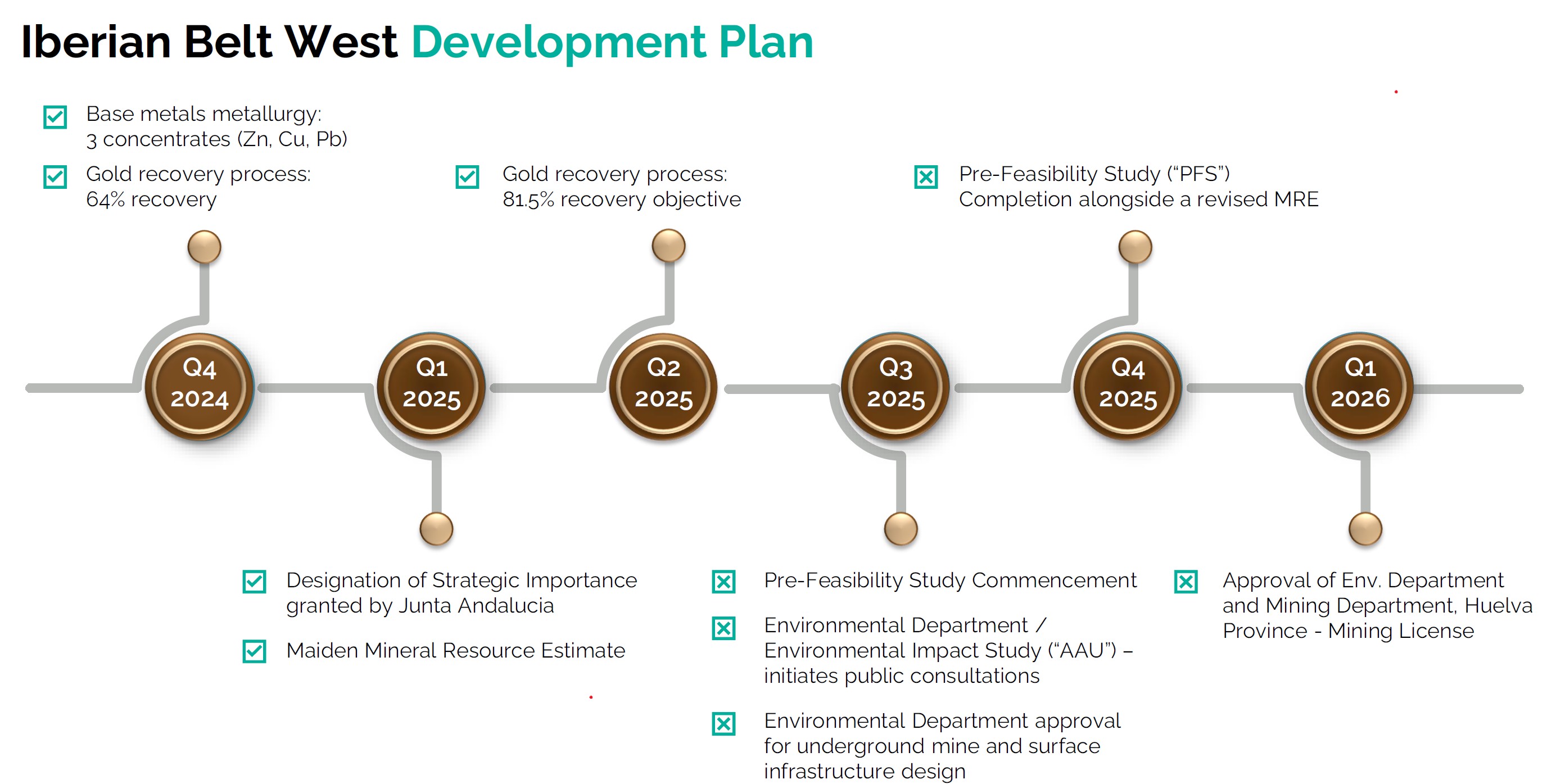

Emerita is in the final stages of permitting for IBW. According to the July 2025 Corporate Presentation, the Environmental Impact Declaration (EID) is expected in early September 2025. This is followed by submission for the Mining Exploitation Permit, scheduled for Q1 2026. The Pre-Feasibility Study (PFS) and updated resource estimate are expected by late December 2025. With the Strategic Project status, all permitting processes are fast-tracked and coordinated under a special regional framework.

The permitting process for the IBW Project is now in its final and most critical stages. As of July 2025, Emerita has confirmed in its Corporate Presentation that it is approaching key milestones that pave the way for development and eventual construction.

¶ Environmental Impact Declaration (EID)

The Declaración de Impacto Ambiental (DIA), or EID, is the most important environmental regulatory step in Spain’s mining permitting process. Emerita submitted the Environmental Impact Study (EIS) for IBW in early 2025. According to the company, the Environmental Impact Declaration is expected by early September 2025. The process has benefited from streamlined coordination under the Strategic Interest Project designation, meaning the relevant agencies are working collaboratively to reach a timely decision. The EID is the necessary prerequisite for submitting the Mining Exploitation Permit.

¶ Mining Exploitation Permit (MEP)

Once the EID is granted, Emerita will formally submit its Mining Exploitation Permit application (known in Spanish as the “Concesión de Explotación Minera”) to the Junta de Andalucía. This step formally licenses the company to construct and operate the mine, contingent on satisfying the EID’s conditions. Per Emerita’s latest timeline, the Mining Exploitation Permit is expected by Q1 2026. The documentation is already largely prepared and coordinated, allowing for rapid progression post-EID.

¶ Fast-Track Permitting Framework

Thanks to the IBW Project’s designation as a Project of Strategic Interest, the entire permitting process benefits from:

- Unified interdepartmental coordination under the Andalusian Office of Strategic Projects

- Priority timelines for review and response from regulatory bodies

- Reduced administrative bottlenecks typically seen in Spanish mining permitting

This makes IBW one of the most permitting-advanced development-stage projects in the Iberian Pyrite Belt.

¶ Integration with Technical Milestones

The permitting timeline aligns tightly with the company’s internal development goals:

- Pre-Feasibility Study (PFS) is scheduled for late December 2025

- Updated Mineral Resource Estimate (MRE) to accompany the PFS

These documents will form part of the technical foundation submitted alongside the MEP

¶ Regulatory Context

All permitting is conducted under Spain’s national and regional mining and environmental codes, including Ley de Minas Law 21/2013 on Environmental Assessment as well as regional policies linked to the Raw Materials Valley Initiative.

In summary, Emerita is well-positioned on the regulatory front, with IBW progressing in lockstep through the necessary permitting phases. The combination of high-grade resources, a fast-tracked regulatory designation, and close alignment with regional industrial goals makes IBW a standout candidate for near-term development in the EU.

¶ Development Plan

Emerita’s development strategy for the Iberian Belt West (IBW) project is built on a phased, modular approach designed to minimize capital intensity, leverage existing infrastructure, and fast-track production while maximizing flexibility across its three key deposits — La Romanera, La Infanta, and El Cura.

¶ Sequenced Production Strategy

The initial development focus will be La Romanera, which contains over 90% of the current resource base and offers the thickest, most continuous mineralized zones. Following this, El Cura is expected to come online as a satellite deposit due to its proximity and newly emerging size potential. La Infanta, known for its exceptionally high grades, will be integrated in later phases — either as a high-grade blend feedstock or as a distinct production module, depending on its standalone economics and metallurgy.

¶ Plant Design and Flexibility

Emerita is finalizing a plant design tailored for modular expansion, which allows for future capacity upgrades without disrupting early production. The mill will be located centrally to all three deposits, optimizing haul distances and operating costs.

The company has signaled in its filings and investor presentations that IBW will utilize existing infrastructure to minimize capex:

- Grid power access

- Road and rail proximity

- Nearby port facilities in Huelva

¶ Integrated Timeline

Key milestones in the development schedule include:

- Q3 2025: Environmental Impact Declaration (EID) anticipated

- Q4 2025: Pre-Feasibility Study (PFS) and updated Mineral Resource Estimate

- Q1 2026: Submission of Mining Exploitation Permit

- Mid–Late 2026: Targeted construction commencement, subject to permitting

The sequence is designed to allow Emerita to mobilize construction crews immediately upon permitting, ensuring that capital deployment aligns closely with regulatory clearance and market conditions.

¶ Exploration-Linked Upside

Parallel exploration continues at El Cura and the Ontario target. These zones may ultimately be integrated into the life-of-mine plan, increasing overall tonnage and mine life. Notably, the Ontario zone lies along the same VMS corridor as Romanera and El Cura, suggesting geological continuity that could support future expansion without major new capex.

¶ Strategic Synergies

The development plan is supported by Emerita’s participation in the Raw Materials Valley initiative, which provides regional backing for mining infrastructure and skills development. The company's designation as a Strategic Project in Andalucía also ensures:

- Fast-tracked permitting

- Dedicated technical liaisons

- Access to EU-aligned critical raw material support programs

¶ Financing and Execution Readiness

Management has signaled ongoing discussions with strategic and financial partners. With a pre-feasibility foundation in place, Emerita intends to move IBW forward under a developer-operator model, leveraging its experience from past mine builds and taking full advantage of regional cost advantages.

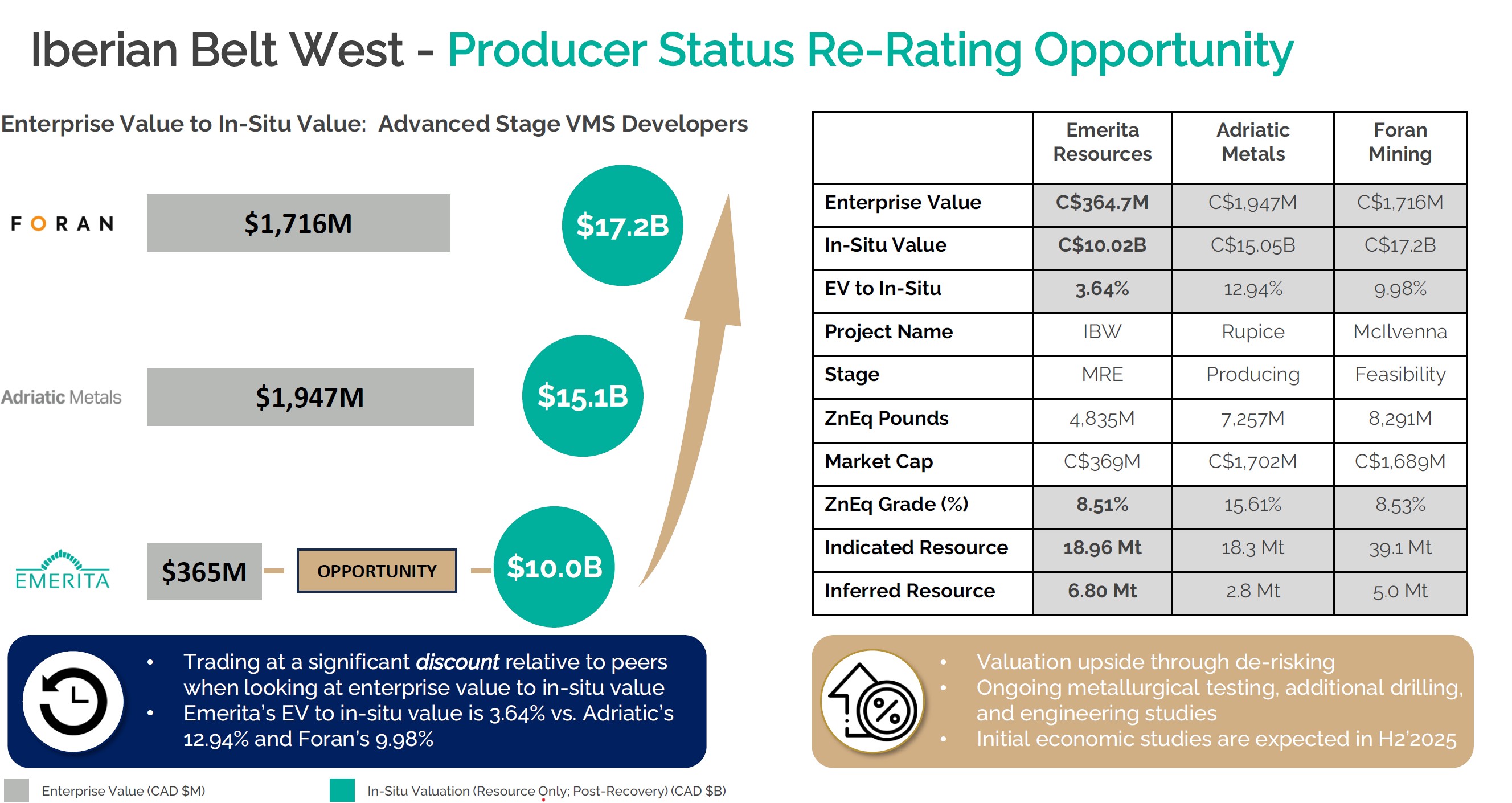

¶ Strategic Summary for Investors

The Iberian Belt West (IBW) Project is the foundation stone of Emerita’s district-scale ambitions in southern Spain. It comprises three known deposits; La Romanera, La Infanta, and El Cura—and now holds a compliant 25.76 million tonnes of high-confidence polymetallic resources (ZnEq basis), with major upside from Nuevo Tintillo and the newly permitted Ontario concession.

¶ Why IBW Matters

- District Hub Potential: IBW is being designed as a central processing platform, with Romanera anchoring Zn-Ag production, Infanta delivering early tonnage, and El Cura–Ontario potentially unlocking a Cu-Au growth front.

- Fully Serviced Location: The project sits beside roads, power, water, ports, and a trained mining workforce—cutting both CapEx and time-to-build.

- EU Strategic Relevance: Recognised as a Project of Strategic Interest by the Junta de Andalucía and aligned with the EU’s Critical Raw Materials strategy.

- Scalable and Derisked: A Pre-Feasibility Study is now underway, fast-tracked under Strategic status. IBW already bypassed the PEA, and the Environmental Permit is expected in Q3 2025.

¶ What's Changing

The 5,600 ha Ontario permit, adjacent to El Cura and Romanera, triples Emerita’s land package and suggests the mineralised VMS system continues westward. Historic mines within Ontario produced >13% Cu — mirroring El Cura’s Cu-Au geochemistry, not Romanera’s Zn-Ag dominance. Emerita’s hypothesis, echoed in recent interviews with Juan Luis Pozo, is that El Cura is not just a deposit—it’s the structural key to this westward expansion.

¶ What the Market Is Missing

Despite IBW’s scale and progress, the market continues to price Emerita largely as an AZN legal binary, giving little credit to its standalone growth engine:

- IBW now exceeds Adriatic Metals in tonnage, but trades at ~C$5.8M per Mt of resource vs. Adriatic’s C$57M/Mt.

- Even applying steep early-stage discounts, IBW implies a C$1.00–1.60/share floor on valuation fundamentals.

- IBW alone could support Emerita’s entire market cap, before factoring in Aznalcóllar or Nuevo Tintillo.

¶ Technical Report

Technical Report 43-101 - April 30, 2025 - Sedar Link | PDF

Technical Report 43-101 - July 5, 2023 - Link | PDF